Local Market Update – February 2019

January brought more good news for homebuyers. Prices were down, inventory was up and interest rates hovered near a nine-month low. Those factors drove more buyers into the market and resulted in an uptick in sales for the month. We’ll see how this transitioning market evolves as we head into the prime Spring home buying season.

Eastside

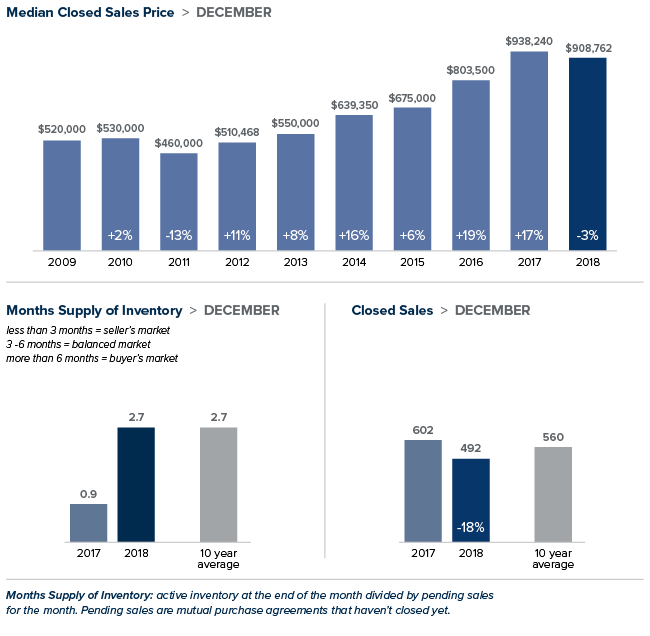

The most expensive region in King County saw prices soften in January. The median price of a single-family home on the Eastside dropped 3 percent over last January to $910,000. It’s an excellent time for buyers to leverage the cooling market and negotiate terms that work best for their needs. Last January, 39 percent of the homes in this area sold for over asking price. This January, that figure dropped to 12 percent. With its favorable business climate and high rankings for both economic growth and technology capabilities, demand on the Eastside is projected to remain strong.

King County

January marked the first time home prices in King County decreased year-over-year in seven years. The median price of a single-family home was $610,0000, a drop of 3 percent over the prior year. Inventory more than doubled. Unlike recent months, this was due primarily to more people putting their homes on the market, as opposed to homes taking longer to sell. Despite the surge in listings there is just two months of available inventory, far short of what is needed to meet demand.

Seattle

The median price of a single-family home in the city was $711,500 in January, a decrease of 6 percent year-over-year. Despite a 107 percent increase in homes for sale compared to a year ago, Seattle continues to have the tightest inventory in King County with less than two months of supply. A booming economy that shows no signs of slowing continues to draw more people to the city. The area will have to significantly add more inventory to meet that growing demand.

Snohomish County

The median price of a single-family home in January inched up 1 percent from last year to $455,000. That price is down from the median of $470,000 recorded in December. Snohomish County also saw a surge in inventory with the number of homes on the market double of what it was last year at this time.

This post originally appeared on the WindermereEastside.com Blog.

Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please contact me.

ECONOMIC OVERVIEW

The Washington State economy continues to add jobs at an above-average rate, though the pace of growth is starting to slow as the business cycle matures. Over the past 12 months, the state added 96,600 new jobs, representing an annual growth rate of 2.9% — well above the national rate of 1.7%. Private sector employment gains continue to be quite strong, increasing at an annual rate of 3.6%. Public sector employment was down 0.3%. The strongest growth sectors were Real Estate Brokerage and Leasing (+11.4%), Employment Services (+10.3%), and Residential Construction (+10.2%). During fourth quarter, the state’s unemployment rate was 4.3%, down from 4.7% a year ago.

My latest economic forecast suggests that statewide job growth in 2019 will still be positive but is expected to slow. We should see an additional 83,480 new jobs, which would be a year-over-year increase of 2.4%.

HOME SALES ACTIVITY

- There were 17,353 home sales during the fourth quarter of 2018. Year-over-year sales growth started to slow in the third quarter and this trend continued through the end of the year. Sales were down 16% compared to the fourth quarter of 2017.

- The slowdown in home sales was mainly a function of increasing listing activity, which was up 38.8% compared to the fourth quarter of 2017 (continuing a trend that started earlier in the year). Almost all of the increases in listings were in King and Snohomish Counties. There were more modest increases in Pierce, Thurston, Kitsap, Skagit, and Island Counties. Listing activity was down across the balance of the region.

- Only two counties—Mason and Lewis—saw sales rise compared to the fourth quarter of 2017, with the balance of the region seeing lower levels of sales activity.

- We saw the traditional drop in listings in the fourth quarter compared to the third quarter, but I fully anticipate that we will see another jump in listings when the spring market hits. The big question will be to what degree listings will rise.

HOME PRICES

- With greater choice, home price growth in Western Washington continued to slow in fourth quarter, with a

year-over-year increase of 5% to $486,667. Notably, prices were down 3.3% compared to the third quarter of 2018.

year-over-year increase of 5% to $486,667. Notably, prices were down 3.3% compared to the third quarter of 2018. - Home prices, although higher than a year ago, continue to slow. As mentioned earlier, we have seen significant increases in inventory and this will slow down price gains. I maintain my belief that this is a good thing, as the pace at which home prices were rising was unsustainable.

- When compared to the same period a year ago, price growth was strongest in Skagit County, where home prices were up 13.7%. Three other counties experienced double-digit price increases.

- Price growth has been moderating for the past two quarters and I believe that we have reached a price ceiling in many markets. I would not be surprised to see further drops in prices across the region in the first half of 2019, but they should start to resume their upward trend in the second half of the year.

DAYS ON MARKET

- The average number of days it took to sell a home dropped three days compared to the same quarter of 2017.

- Thurston County joined King County as the tightest markets in Western Washington, with homes taking an average of 35 days to sell. There were eight counties that saw the length of time it took to sell a home drop compared to the same period a year ago. Market time rose in five counties and was unchanged in two.

- Across the entire region, it took an average of 51 days to sell a home in the fourth quarter of 2018. This is down from 54 days in the fourth quarter of 2017 but up by 12 days when compared to the third quarter of 2018.

- I suggested in the third quarter Gardner Report that we should be prepared for days on market to increase, and that has proven to be accurate. I expect this trend will continue, but this is typical of a regional market that is moving back to becoming balanced.

CONCLUSIONS

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. I am continuing to move the needle toward buyers as price growth moderates and listing inventory continues to rise.

2019 will be the year that we get closer to having a more balanced housing market. Buyer and seller psychology will continue to be significant factors as home sellers remain optimistic about the value of their home, while buyers feel significantly less pressure to buy. Look for the first half of 2019 to be fairly slow as buyers sit on the sidelines waiting for price stability, but then I do expect to see a more buoyant second half of the year.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the UnIversity of Washington where he also lectures in real estate economics.

Windermere Foundation Surpasses $38 Million In Total Donations Raised

2018 concluded with another great year of fundraising and giving for the Windermere Foundation, thanks to the continued support of Windermere franchise owners, agents, staff, and the community. Nearly $2.5 million was raised in 2018, bringing our grand total to over $38 million raised since the Foundation’s inception in 1989! During the past year, nearly $1.9 million was donated to non-profit organizations throughout the Western U.S. that provide much-needed services to low-income and homeless families. In 2018, the Windermere Foundation fulfilled 689 grant requests and served 507 non-profit organizations.

A portion of the money raised every year is due in part to our agents who each make a donation to the Windermere Foundation from every commission they earn. Additional donations from Windermere agents, the community, and fundraisers made up 68% of the money collected in 2018. Each Windermere office has their own Foundation funds, which enable them to support local non-profits in their communities.

One organization that received Windermere Foundation donations from several Windermere Real Estate offices in the Seattle area is Treehouse. Treehouse’s mission is to give foster kids a childhood and a future. Their goal that they have set to achieve by 2022, is to see youth in foster care graduate from high school at the same rate as their peers across Washington State. And to provide them with support and a plan to launch successfully into adulthood. Donations from the Windermere Foundation have helped Treehouse clients like Ashley, get the support she needed to turn her life around.

“I didn’t have a childhood that all kids should have–like making friends my age or playing sports. I changed the path that I was on because I wanted to give people a reason to believe in me. You have to want to change and speak your truth, but you can’t do it without people believing in you. You can get through the darkest situations, you just gotta look for a little crack of light. Treehouse is that crack of light for me,” ~Ashley

2018 also marked the third year of our #tacklehomelessness campaign with the Seattle Seahawks, in which Windermere committed to donating $100 for every Seahawks home game defensive tackle to YouthCare, a non-profit organization that provides critical services to homeless youth. While the Seahawks didn’t make it past the first round of the playoffs, they did help us raise $31,900. When added to previous seasons, the total donation for the past three years is $98,700! We are grateful for the opportunity to provide additional support to homeless youth thanks to the Seahawks, YouthCare, and the #tacklehomelessnesscampaign.

Thanks to our agents, offices, and everyone who supports the Windermere Foundation, we have been able to make a difference in the lives of many families in our local communities over the past 30 years. If you’d like to help support programs in your community, please click the Donate button.

To learn more about the Windermere Foundation, visit http://www.windermere.com/foundation.

This was originally posted on the Windermere Blog.

2019 Economic and Housing Forecast

What a year it has been for both the U.S. economy and the national housing market. After several years of above-average economic and home price growth, 2018 marked the start of a slowdown in the residential real estate market. As the year comes to a close, it’s time for me to dust off my crystal ball to see what we can expect in 2019.

The U.S. Economy

Despite the turbulence that the ongoing trade wars with China are causing, I still expect the U.S. economy to have one more year of relatively solid growth before we likely enter a recession in 2020. Yes, it’s the dreaded “R” word, but before you panic, there are some things to bear in mind.

Firstly, any cyclical downturn will not be driven by housing. Although it is almost impossible to predict exactly what will be the “straw that breaks the camel’s back”, I believe it will likely be caused by one of the following three things: an ongoing trade war, the Federal Reserve raising interest rates too quickly, or excessive corporate debt levels. That said, we still have another year of solid growth ahead of us, so I think it’s more important to focus on 2019 for now.

The U.S. Housing Market

Existing Home Sales

This paper is being written well before the year-end numbers come out, but I expect 2018 home sales will be about 3.5% lower than the prior year. Sales started to slow last spring as we breached affordability limits and more homes came on the market. In 2019, I anticipate that home sales will rebound modestly and rise by 1.9% to a little over 5.4 million units.

Existing Home Prices

We will likely end 2018 with a median home price of about $260,000 – up 5.4% from 2017. In 2019 I expect prices to continue rising, but at a slower rate as we move toward a more balanced housing market. I’m forecasting the median home price to increase by 4.4% as rising mortgage rates continue to act as a headwind to home price growth.

New Home Sales

In a somewhat similar manner to existing home sales, new home sales started to slow in the spring of 2018, but the overall trend has been positive since 2011. I expect that to continue in 2019 with sales increasing by 6.9% to 695,000 units – the highest level seen since 2007.

That being said, the level of new construction remains well below the long-term average. Builders continue to struggle with land, labor, and material costs, and this is an issue that is not likely to be solved in 2019. Furthermore, these constraints are forcing developers to primarily build higher-priced homes, which does little to meet the substantial demand by first-time buyers.

Mortgage Rates

In last year’s forecast, I suggested that 5% interest rates would be a 2019 story, not a 2018 story. This prediction has proven accurate with the average 30-year conforming rates measured at 4.87% in November, and highly unlikely to breach the 5% barrier before the end of the year.

In 2019, I expect interest rates to continue trending higher, but we may see periods of modest contraction or levelling. We will likely end the year with the 30-year fixed rate at around 5.7%, which means that 6% interest rates are more apt to be a 2020 story.

I also believe that non-conforming (or jumbo) rates will remain remarkably competitive. Banks appear to be comfortable with the risk and ultimately, the return, that this product offers, so expect jumbo loan yields to track conforming loans quite closely.

Conclusions

There are still voices out there that seem to suggest the housing market is headed for calamity and that another housing bubble is forming, or in some cases, is already deflating. In all the data that I review, I just don’t see this happening. Credit quality for new mortgage holders remains very high and the median down payment (as a percentage of home price) is at its highest level since 2004.

That is not to say that there aren’t several markets around the country that are overpriced, but just because a market is overvalued, does not mean that a bubble is in place. It simply means that forward price growth in these markets will be lower to allow income levels to rise sufficiently.

Finally, if there is a big story for 2019, I believe it will be the ongoing resurgence of first-time buyers. While these buyers face challenges regarding student debt and the ability to save for a down payment, they are definitely on the comeback and likely to purchase more homes next year than any other buyer demographic.

Originally published on Inman News.

How to Stay Safe During the Holidays With Design and Planning

While many people look forward to the arrival of a jolly red-suited visitor one night this winter, for all of us the holidays are a gift and a danger. All of us want to stay safe from burglary, and there’s nothing paranoid about taking a bit of extra time to stay safe. The holidays are a time for relaxation, peace of mind, and sharing love and affection. From old-school security tricks to new digital home monitoring tools, there are many options when it comes to keeping our homes safe and preserving that sensibility.

Security bars and gates:

Sometimes the simplest security is just deterring people from trying to get in. While security bars across windows are a great way to keep intruders out of your home, they can be a real eyesore. Luckily, there are now options for decorative security bars that simultaneously protect your home while enhancing its beauty.

Upgrade your locks:

A poorly installed deadbolt can make it easy for an intruder to kick in your door. Start by making sure that your door frames are in good condition and then look into getting a higher quality deadbolt. You’ll find everything from classic models with keys, or digital options that require passcodes or a fingerprint.

It’s also a good idea to check all the locks on your windows. Some older models are easy to jimmy open with a little wiggling. For ground floor windows, you may want to consider double locks. It goes without saying, leaving windows open during the summer is a bad idea – especially those that can be easily accessed.

Exterior and interior home lighting:

Having your exterior lights on timers or motion sensors is a good way to deter nighttime snoopers. Add sensor lights to key entry points on your home, including the front door, back door, and/or basement entries. If you have an unused side yard, consider lighting there too. Keeping your home lit makes unwanted visitors weary of being seen.

If you will be gone from your home for an extended period of time, consider using timed lighting options in your home to make it appear someone is around. You can select timers for bedrooms or living areas. Also, you can program a radio to turn on and off for sound.

Alarm systems:

If you are considering an alarm, you have an array of options that vary from self-install motion detection kits to full-service home security systems. If you choose to do-it-yourself, you will want to install motion detectors on doors and windows – especially those that can be easily accessed on the ground floor. In most cases, these kits also offer a 24-hour call service for an extra fee.

Full-service security systems can include everything from an alarm system and panic buttons to and integration with your smoke detectors/ fire prevention system. These services are expensive up front but usually have a reasonable monthly rate. And keep in mind, having a home security system installed can also reduce your insurance rates.

If installing an alarm system is cost-prohibitive or does not fit your lifestyle, consider purchasing stickers and a sign that state that your home is monitored by a trusted security system, and place them so they are visible at every entrance.

Security cameras:

Security cameras are readily available for home installation. You can install these in prominently viewed places to deter burglars. There are do-it-yourself install options and professional systems that come along with monitoring services. There are even options that will work with your smartphone. If the cost of security cameras is too steep for your budget, you can purchase fake cameras to act as a visible deterrent for intruders.

Build your community:

Programs like Neighborhood Watch are very successful in some communities, by creating an environment where everyone is looking out for each other. Building close-knit relationships with your neighbors can go a long way in making you feel safe at home. Whether this is through a formalized program, or a shared agreement with your community, developing relationships with your neighbors is a great way to keep your home safe.

This post originally appeared on the Windermere Blog.

Bringing Your Plants Inside for Winter

Winters in many parts of the Western U.S. can easily see temperatures that dip down below freezing. For many gardening homeowners, this can be troublesome when precious plants are concerned. Covering your plants with sheets may not be enough to save a plant from succumbing to freezing temperatures. Check out these ways to bring your plants inside for winter:

Take Inventory of Plants

Unless you have planted exotic plants that are definitely not going to survive cold temperatures, there are probably more than a few plants within your yard that should be okay. Healthy native plants are used to the climate of your area and should be able to withstand the winter temperatures without any issue. Those plants that are better suited for a higher growing zone will need to be cared for in order to best survive the season. Consider every plant within your yard and access their health, maturity, and location in order to choose which plants to bring indoors.

Indoor Placement

Exotic plants love the sun and should be placed near southern facing windows that aren’t drafty or cold. Create a spot within your home that is far from drafts or cold breezes from open doors. Spread plastic sheeting to protect flooring and create a little greenhouse group of plants that will still receive plenty of sunlight. Refrain from placing plants too close together in order to allow for equal access to sunlight and air flow.

Container Issues

Many potted plants can easily be moved indoors without having to transplant them. Easily place potted plants in a group to ride out the winter season. In-ground plants within your landscape will need to be transplanted to a container in order to bring them indoors. Make sure that you consider the size of the plant and use a container that is big enough around for the root ball of the plant. Using a container that is much too large for a plant is better than one that is too small and could damage the plant’s root system.

Keep the Fan On

Many indoor plants enjoy being near a window but will also need adequate air circulation to prevent soggy soil conditions. It is a good idea to keep the ceiling fan on in the room, at a low speed, in order to keep the air moving within the room. Don’t place plants too close to heating vents in order to keep them from becoming too hot and overheated. Plants that produce browning leaves will need to be moved to a room with a humidifier in order to keep them in good condition as well.

Keep Pets Away

Many indoor plants can become curious items for an indoor pet. Make sure to keep pets away from plants in order to keep both safe. Some tropical plants are toxic for animals and some pets can prove damaging to plants. Create a barrier between plants and animals so that both are kept safe during the winter season.

Water & Dust

Keeping your plants watered indoors may look different than what it receives in an outdoor environment. Make sure to consider the plant before watering in order to keep it in soil that it prefers. Many winter climates will not see a lot of added water so choosing to water your indoor plants at a minimum will help mimic those conditions that it would receive outside.

Also, check the plants for accumulating dust that can easily be found after a few weeks indoors. Dust off plants on a regular basis in order to keep them healthy and able to absorb important nutrients. Use a wet cloth to gently wipe down leaves in order to keep dust free from indoor plants.

There are many things to consider when choosing to bring plants indoors for winter. Make sure to choose plants carefully and monitor their progress as the winter season wears on. Consider all of these tips for bringing your plants inside for winter in order to keep them from freezing outdoors.

Kelly Holland is a gardening and landscape design writer who loves experimenting in her kitchen. Her quirky nature loves a bright color palette so naturally, her coveted garden is covered in a rainbow of fruits, vegetable, and flowers.

This post originally appeared on the Windermere Blog.

Eastside Market Update – October

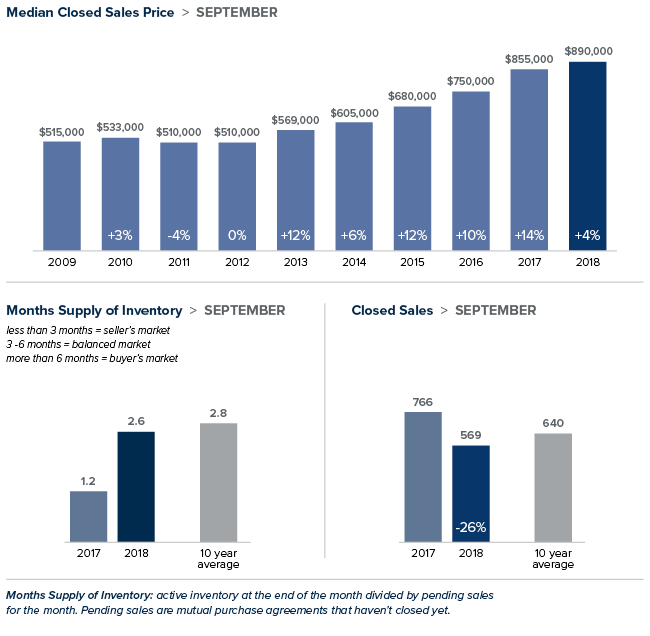

It appears that balance is slowly returning to the local housing market. Home price growth slowed in September. Inventory continued to climb, but is still far short of the four to six months that indicate a normal market. Homes are staying on the market longer, giving buyers the breathing room to make the right choice for their situation. With our region’s healthy job growth, and demand still exceeding supply, it’s likely to take some time to move to a fully balanced market.

Eastside

Home price increases moderated into the single-digits in September. The median price of a single-family home on the Eastside was up 4 percent from the same time last year to $890,0000 but down from a median price of $935,000 in August. Inventory increased significantly and price drops jumped. While the market is softening, the recent expanded presence of Google and Facebook on the Eastside means demand should stay strong. In addition, the area’s excellent school system continues to be a large draw for buyers both locally and internationally.

King County

Inventory was up 68 percent year-over-year in King County due to a higher number of sellers listing their homes and fewer sales. There is now more than two months of inventory in the county, a number we haven’t seen in nearly four years. Despite the increase, there is a long way to go to reach the four to six months of inventory that is considered balanced. In September, the median price of a single-family home was $668,000; an increase of 7 percent from the same time last year and virtually unchanged from August.

Seattle

Inventory in Seattle surged in September from a year ago. Only San Jose, CA saw the number of homes for sale rise faster than Seattle last month. The median home price in September was $775,000. Up slightly from the $760,000 median price in August and a 7 percent increase from last year. The double-digit price growth of past years appear to be waning and overzealous sellers who listed their homes at unrealistically high prices have been forced to reduce them. Bidding wars have declined and the typical well-priced house is now selling right at asking price.

Snohomish County

While not nearly as dramatic as the case in King County, inventory in Snohomish County was up 40 percent. The area has just over two months of inventory with home prices moderating. The median price of a single-family home increased 8 percent over a year ago to $485,000. That’s down from the $492,000 median reached in August and $26,000 less than the peak of the market reached in spring.

This post originally appeared on the WindermereEastside.com Blog.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

year-over-year increase of 5% to $486,667. Notably, prices were down 3.3% compared to the third quarter of 2018.

year-over-year increase of 5% to $486,667. Notably, prices were down 3.3% compared to the third quarter of 2018.